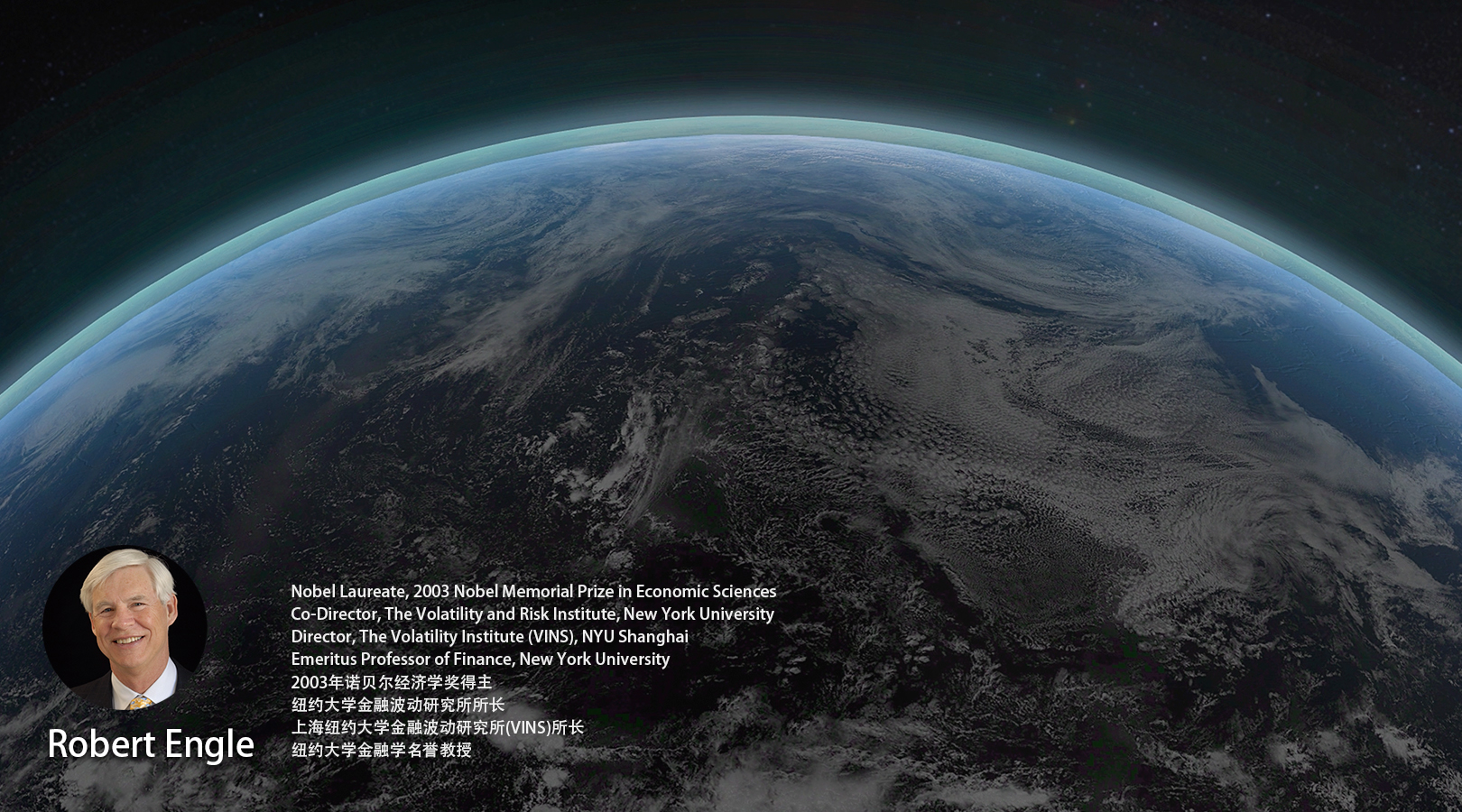

罗伯特.恩格尔 Robert Engle

罗伯特-恩格尔因其对自回归条件异方差(ARCH)概念的研究而获得 2003 年诺贝尔经济学奖。他为时变波动的统计建模开发了这一方法,并证明这些技术能准确捕捉许多时间序列的特性。恩格尔教授与加州大学圣迭戈分校的克莱夫-格兰杰(Clive W. J. Granger)分享了这一奖项。

恩格尔教授是时间序列分析方面的专家,长期关注金融市场分析。他的 ARCH 模型及其广义模型不仅成为研究人员不可或缺的工具,也成为金融市场分析人员在资产定价和评估投资组合风险时不可或缺的工具。他的研究还产生了一些创新的统计方法,如协整、共同特征、自回归条件期限(ACD)、CAViaR 以及现在的动态条件相关(DCC)模型。

他目前是纽约大学斯特恩波动与风险研究所的联合主任,也是金融计量经济学会(SoFiE)的联合创始主席,该学会是设在纽约大学的一个全球性非营利组织。在 2000 年加入纽约大学斯特恩分校之前,恩格尔教授曾任加州大学圣地亚哥分校校长副教授和经济系主任,以及麻省理工学院经济学副教授。

Robert Engle was awarded the 2003 Nobel Prize in Economics for his research on the concept of autoregressive conditional heteroskedasticity (ARCH). He developed this method for statistical modeling of time-varying volatility and demonstrated that these techniques accurately capture the properties of many time series. Professor Engle shared the prize with Clive W. J. Granger of the University of California at San Diego.

Professor Engle is an expert in time series analysis with a long-standing interest in the analysis of financial markets. His ARCH model and its generalizations have become indispensable tools not only for researchers, but also for analysts of financial markets, who use them in asset pricing and in evaluating portfolio risk. His research has also produced such innovative statistical methods as cointegration, common features, autoregressive conditional duration (ACD), CAViaR and now dynamic conditional correlation (DCC) models.

He is currently the Co-Director of the NYU Stern Volatility and Risk Institute and is the Co-Founding President of the Society for Financial Econometrics (SoFiE), a global non-profit organization housed at NYU. Before joining NYU Stern in 2000, Professor Engle was Chancellor's Associates Professor and Economics Department Chair at the University of California, San Diego, and Associate Professor of Economics at the Massachusetts Institute of Technology.